The Benefits of Short Term Income Protection

•••Insight

August 2018

Most EU citizens would lose 30-50% of their net income if they became sick. How would you manage, should the unexpected occur?

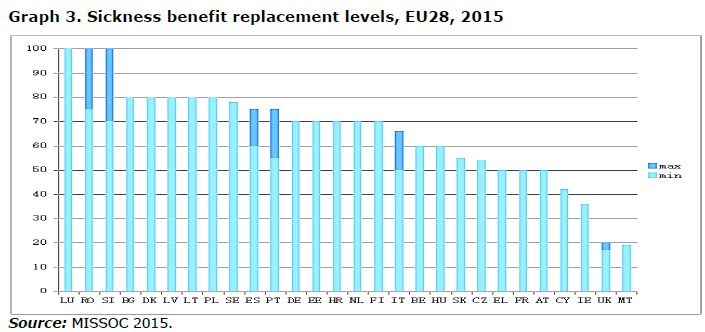

Research by the European Social Policy Network has shown that, over the past decade, and particularly since the economic crisis in 2008, most of the European Member States have made efforts to reduce public finance expenditure on sickness benefits. In almost all European countries, this has led to a tightening of eligibility conditions, and in some cases also a reduction in benefit rates.

Although all European Member States provide sick leave and sickness benefits to their residents, the percentage of income covered by state sickness benefit varies significantly between EU countries. In some countries that provide flat-rate benefits the replacement level can be estimated at as little as 20%.

Sickness protection is especially variable for the self-employed, whose entitlement to benefits is often different to those in contracted employment.

Many people believe that if they become unable to work, the benefits that their local government provides will be sufficient to meet their needs. However, unless you are able to take early retirement, or you have a partner or family member who is able to cover your outgoings, it is possible that your sick pay and savings combined would not be enough to support you and your family should the unexpected occur. In such circumstances, you may benefit from having short term income protection cover.

Short term income protection insurance is designed to help you by providing a regular income if you can't work because you become injured as a result of an accident or you become ill.

You can normally select your level of coverage from a number of options at the outset of the policy.

Payments are generally set to start after your sick pay ends, and to finish either after you are back at work, or after a fixed period of time; whichever happens first.

Maiden is pleased to offer short-term income protection to customers via a number of our existing partners. We are also working constantly to design products tailored to new partners, and are looking forward to making income protection products available to many more customers in the future.

Short Term Income Protection underwritten by Maiden:

- Covers all of the illnesses and injuries that you would expect to be covered, with no unreasonable exclusions.

- The terms and conditions are fair, transparent and easy to understand.

- The cost of the premium represents good value for money.

If you’re not sure whether you might need income protection, here are three steps you can take:

- Calculate what your monthly outgoings are.

- Check what your entitlement to sick pay is, and how long you are entitled to receive it for.

- Consider how you might cover the difference if you become unable to work for a period of time. It may be that purchasing a short-term income protection is a cost-effective way for you to cover the shortfall.